Life Insurance

Life insurance ensures a family’s financial stability by replacing the income of a key member or covering burial costs without added stress. Different types of insurance offer peace of mind, protecting your family from financial distress if the unexpected occurs.

How does Life Insurance work?

A life insurance policy guarantees a death benefit payment to your beneficiaries upon the death of the insured individual. You have the option to select who is covered by the policy and who will receive the funds when the insured passes away. The amount of the death benefit is determined by the terms outlined in the term policy.

Who needs Life Insurance?

Life insurance is ideal for those who believe their loved ones will require assistance in replacing their income in the event of their death. This applies to individuals with families and limited savings, as well as retirees who may have a dependent spouse. Overall, life insurance is essential for every family member. In an unpredictable world, it’s crucial to protect ourselves against unexpected events.

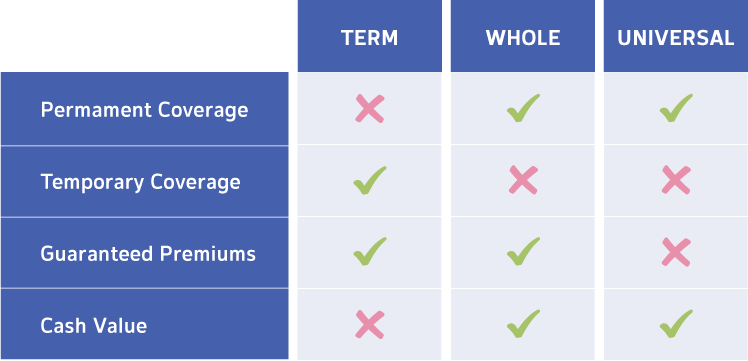

Types of Life Insurance

|

TERM |

WHOLE |

UNIVERSAL |

|

|---|---|---|---|

|

Permament Coverage |

|

|

|

|

Temporary Coverage |

|

|

|

|

Guaranteed Premiums |

|

|

|

|

Cash Value |

|

|

|

How much money will beneficiaries receive?

The amount beneficiaries receive is determined by the term policy you choose. Although the amount can be adjusted with certain policies, but in most cases, the death benefit remains fixed throughout the duration of the term policy.

Find Life Insurance

If you are ready to purchase a life insurance policy, get help from our professionals. The insurance team at Complete Coverage is ready for your call.